Free cash flow to equity free#

It is important to note the two different types of Free Cash Flows. Because of this, FCF is usually used for DCF analysis and valuing companies. Unlike the metrics, EBITA, EBIT, and Net Income, FCF adjusts for capital expenditures and changes in cash due to operating assets and liabilities. It measures a company's profitability after it accounts for cash outflows from operations and Capex. What is the Difference between FCFE and FCFF?įirst, let's discuss simple Free Cash Flow (FCF). Lastly, if a company's metric is equal to the amount it is spending to buy back shares and pay dividends, the firm uses its total Free Cash Flow To Equity to pay its investors. When a company's metric is significantly more than its dividend payment funds, it uses the extra Free Cash Flow To Equity to grow its cash level or invest in other sellable securities. If a company's metric is less than the dividend payment and the price to buy back shares, the company is financing with debt, existing capital, or the issuance of new securities. Investors find it ideal when a dividend payment or share repurchase is paid completely using this.

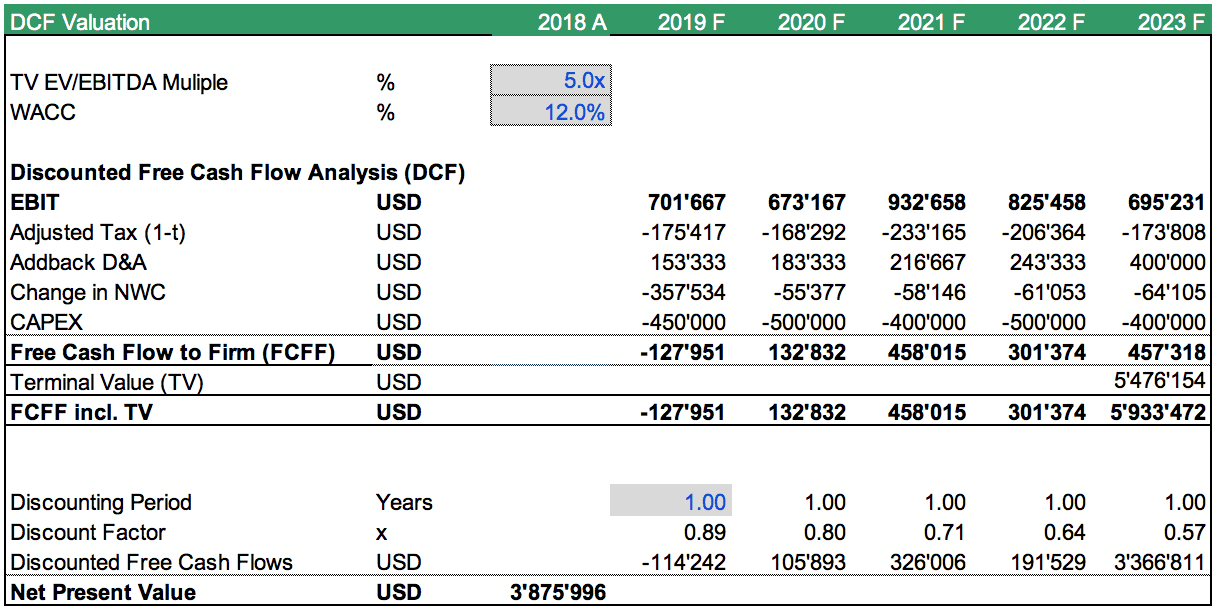

It can be used to analyze whether a company's dividend payments and stock repurchases are financed with Free Cash Flow To Equity or a different form of payment. One crucial aspect is that it estimates the amount of equity available to shareholders, but not necessarily the amount that ends up being paid out to shareholders. The analysis also adjusts for the time value of money. FCFE = the expected value for next yearĭiscounted cash flow analysis is crucial because it estimates the amount of money an investor would receive from an investment in a company.Equity value = the present value of the stock.It can calculate equity value using a discounted cash flow (DCF). Net borrowings = short term debt + long term debt = 10 + 5 = $15 millionįree Cash Flow To Equity = $187 million Example Use.Difference in long term debt = 20 - 15 = 5.Difference in short term debt = 30 - 20 = 10.Net borrowings is the sum of short-term and long-term debt:.Change in Capital Expenditure is (220 - 200) = 20.So, the change in Working Capital is (-70 - 0) = $-70 million.Difference in Current Liabilities = 25 - 25 = 0.Difference in Current Assets = 75 - 145 = -70.Depreciation and Amortization is $12 million.The company's net income for the year 2018 is $250 million. We will use it to calculate the company's FCFE. The balance sheet for Company X is given below. Essentially, net debt represents the amount of cash that a company would have if it paid off all of its debt and the company had enough liquidity to satisfy its debt obligations. Net debt measures how much debt a company carries on its balance sheet compared to its liquid assets. It is typically used for a company's new projects or investments.ĬapEx includes building a new factory or purchasing a new piece of equipment. It focuses on the cash flows from a company's business activities, including purchasing and selling merchandise and providing services.Ĭapital Expenditures (CapEx) are the funds that a company uses for physical assets (e.g., property, plant, and equipment, or (PP&E). The cash from operating activities (CFO) refers to the first section of the cash flow statement.

Let's further examine each section of the equation: The formula is as follows:įree Cash Flow To Equity = Cash From Operating Activities - Capital Expenditures + Net Debt Issued (Repaid)

Free cash flow to equity how to#

Now that we understand what Free Cash Flow to Equity is, let's look at how to calculate it. Companies usually do this in hopes that it will increase their share price.Īll of these options are for the benefit of a company's equity holders. Re-Investments: a company can also reinvest the remaining cash into its business operations. This process reduces dilution and can temporarily and artificially increase a company's share price.ģ.

Share Repurchases: this is when a company buys back shares to reduce the outstanding shares. Dividend Issuances: the company can pay cash dividends to its preferred and common shareholders.Ģ. For example, a company can use this leftover cash to fund the following:ġ. FCFE is the amount of cash remaining solely for equity investors.

0 kommentar(er)

0 kommentar(er)